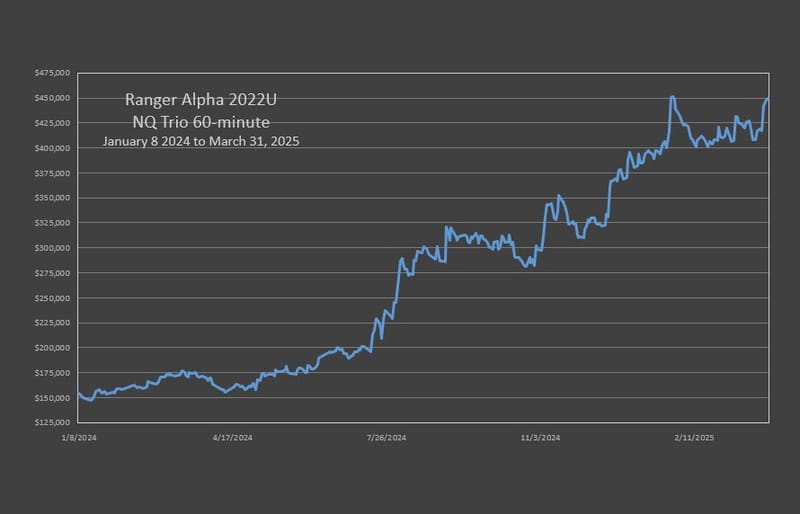

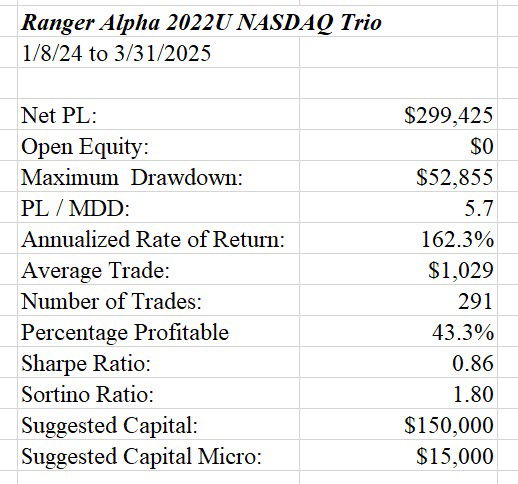

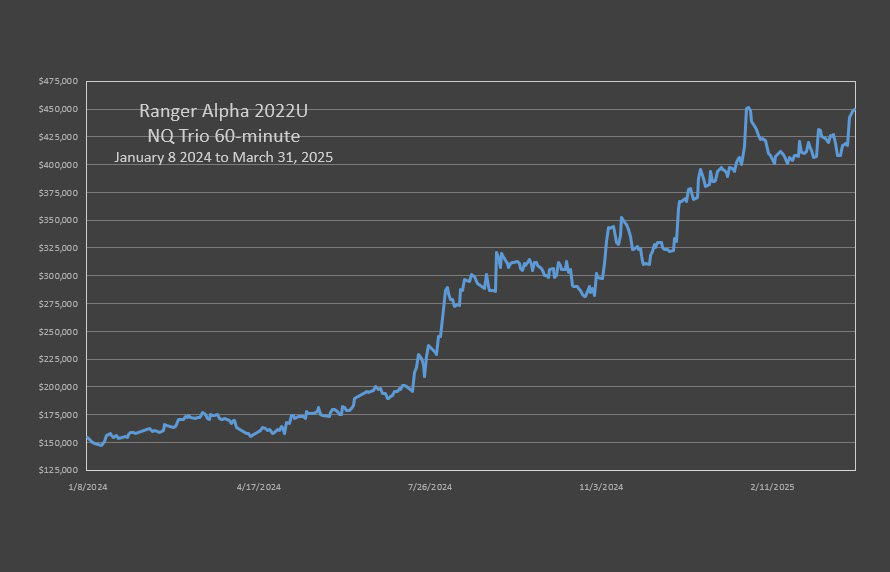

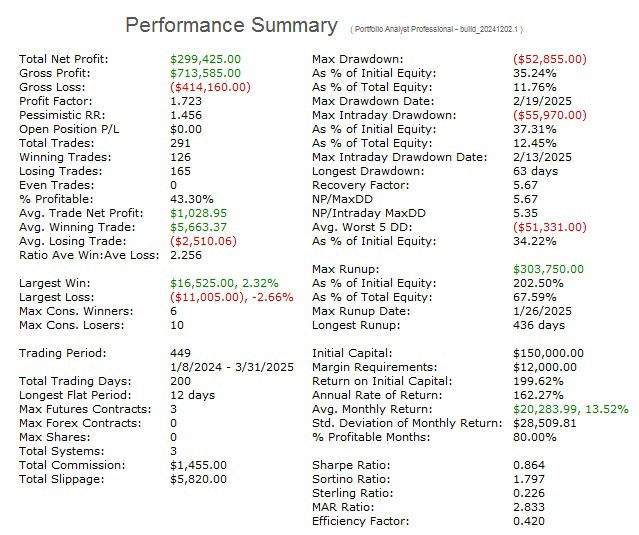

RA'22 NQ 60m Portfolio

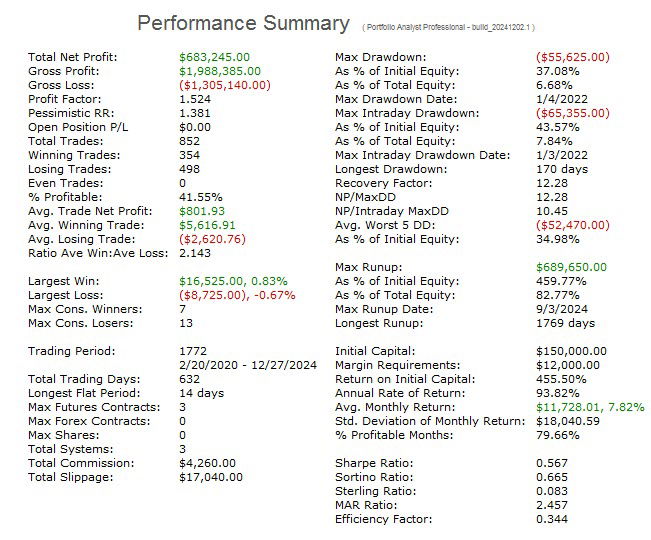

This Ranger Alpha 2022 NQ Portfolio consists of a counter trend, neutral trend and with trend strategy.

The performance here is produced by strategy signals which are all a result of Walk-Forward Analysis.

This is a very important distinction. Walk-forward Analysis (WFA) is widely considered to be the gold-standard in strategy development. Our experience has been that strategies developed with WFA are far more robust than strategies developed with less advanced processes. More detail on WFA can be found in Bob Pardo's classic book The Evaluation and Optimization of Trading Strategies published by J. Wiley.

Each RA22 Trio is the result of a complex process of picking the best of the best from a very deep bench of dozens of different strategies.

First is performance for the three strategy portfolio which is the most current walk-forward windows. These are of variable length based on the length of the selected walk-forward.

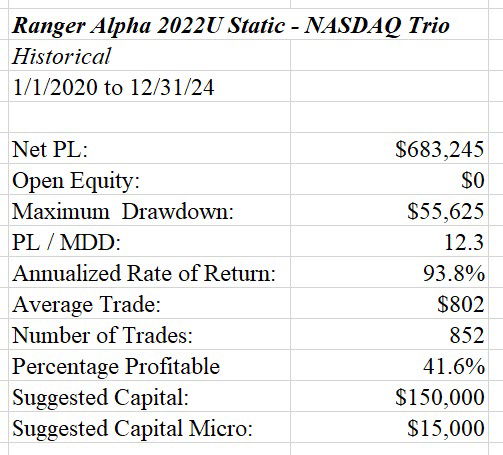

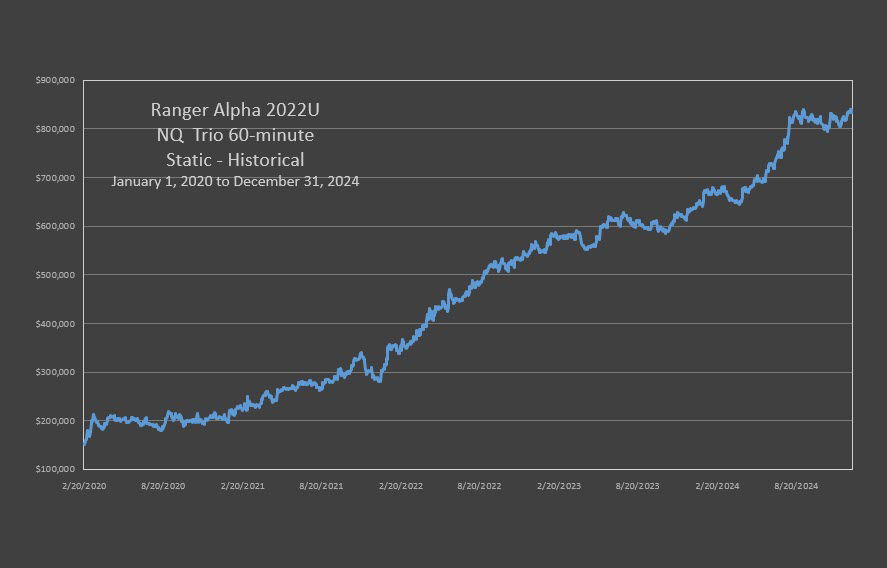

Second is performance for what we refer to as the Static strategy which is the result of the base optimization.

Both strategies are included with purchase.

As the name implies, these were released originally in 2023 and created on historical data which ended 12/31/22. We recently updated all of the strategies. All are the same orginial trading logic. They differ only in their parameters.

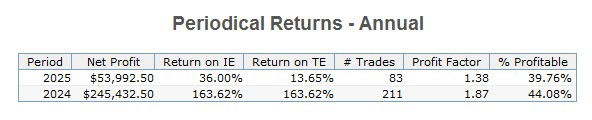

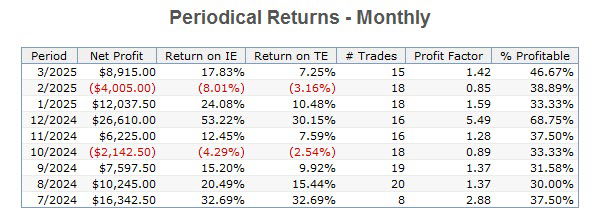

Current Performance covers 1/8/2024 through 3/31/2025

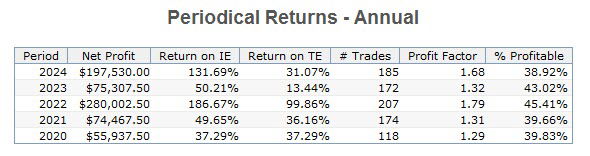

Historical Static Performance covers 1/1/2020 through 12/31/2024

This provides a look at the performance of the strategy over its development period via traditional optimization. It is not a walk-forward analysis. The performance above reflects that of the most current trading window calculated by walk-forward analysis and it is what is traded. The information that follows is for historical perspective. Its performance does not reflect that of the current WFA trading window above. These models are also included with any purchase of the Ranger Alpha strategies.

This is hypothetical performance.

Government Required Disclaimer - Commodity Futures Trading Commission states:

Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made

that any account will or is likely to achieve profits or losses similar to those discussed in this document. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES