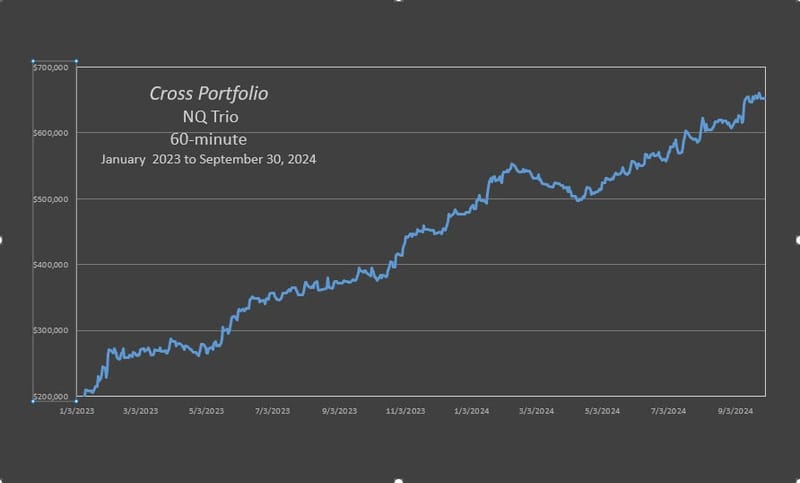

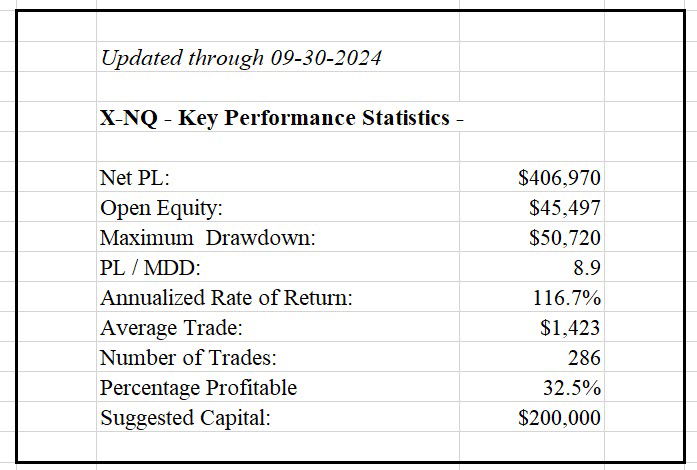

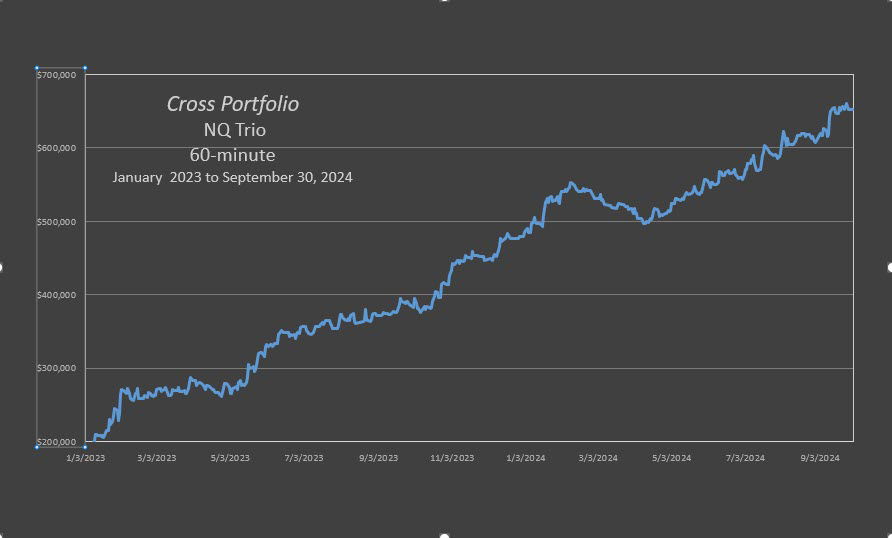

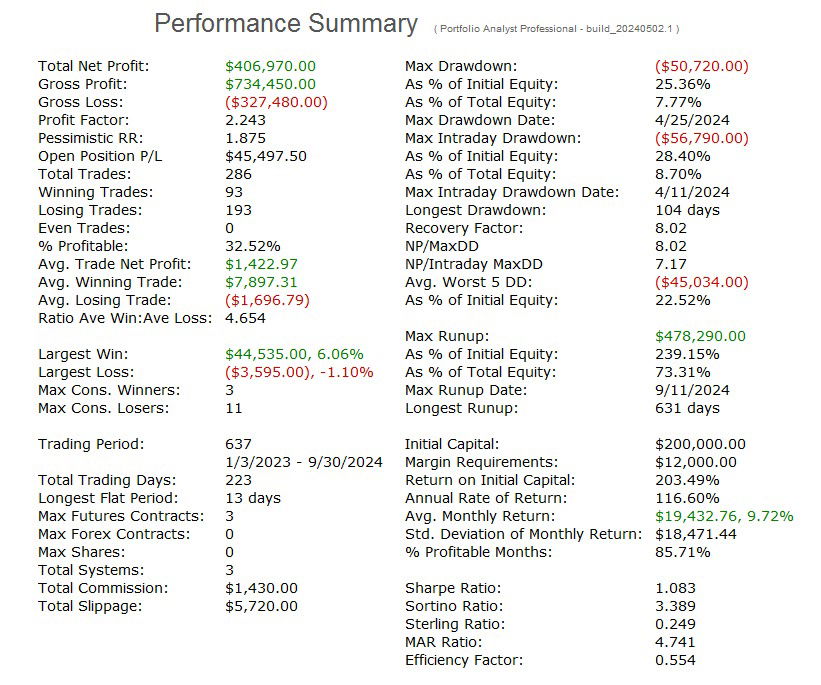

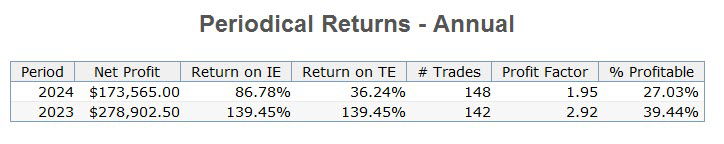

The Cross NQ Trio produced an annual rate of return of 116% through 09-30-2024

Cross BTC Trio

60 minute bars

The portfolio consists of three relatively uncorrelated NQ futures strategies. All of the strategies in the Cross NQ Trio have a $2,000 risk stop and are built on 60 minute bars. Slippage and commission of $22.50 has been charged. NQ futures have a micro contract which brings these high-performance strategies within the reach of many traders.

We have established a relationship with an excellent clearing firm which can auto-trade this portfolio for you on the full size or micro contracts. If you are interested in this reach out to us via our Contact page - https://www.pardo.space/contact.

Suggested account size is $200,000 and $20,000 for the Micro NQ.

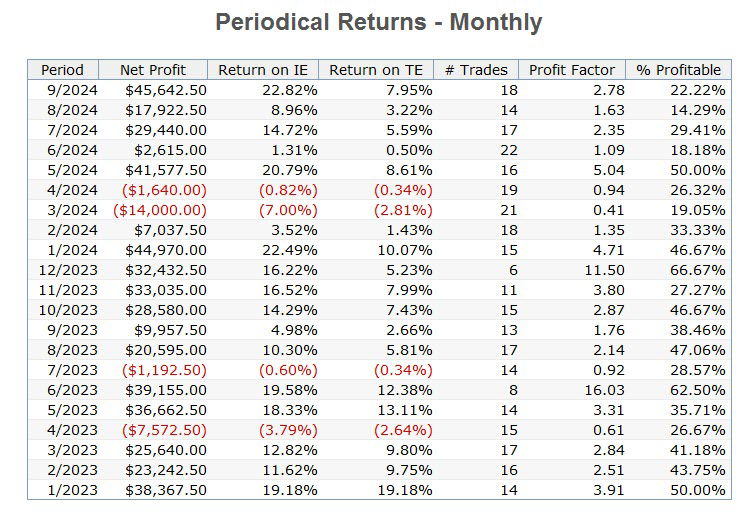

Current Performance

This is the performance of the Cross NQTrio Signal workspaces. These are the strategies that are traded. Due to the shorter Walk-Forward windows in use this cycle, the look back is limited to the shortest window which starts in 1/2023

The Signal strategies will often times have different parameters than the Static strategies. This is the result of walk-forward updating. Consequently, performance between the Static and Signal strategies will diverge.

All of the Cross NQ Trio strategies are built with our proprietary application of Walk-Forward Analysis. What is presented here under Current Performance is the performance of the most current WFA out-of-sample window for each strategy. Our process periodically evaluates the performance of what we call the Static version of the strategy, i.e., the performance of the optimization space, with that of the Dynamic version of the strategy, which is its performance under Walk-Forward Analysis. We select the strategy which exhibits the best current performance. This can and will change from time to time. The performance of the Static portfolio is next presented in the Historical Performance section.

Nonetheless, every Cross NQ Trio strategy has been validated for robustness using our proprietary application of Walk-Forward Analysis. Every strategy in the Cross NQ Trio has to pass this rigorous and unique process. Period.

All Cross NQ Trio strategies are built on a historical look-back from April 1, 2013 through December 31, 2023 and updated through September 30, 2024. Due to the different sizes of the WFA windows used in these strategies, Current Performance starts 1/1/23. Current performance is from 1-3-2023 through 09-30-2024.

This is hypothetical performance.

Government Required Disclaimer - Commodity Futures Trading Commission states:

Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures, stocks or options on the same. No representation is being made

that any account will or is likely to achieve profits or losses similar to those discussed in this document. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.